The market doesn’t move randomly — it moves to hunt your stop-loss.

Introduction: Why You Must Understand Liquidity

If you’ve ever wondered “Why does price hit my stop-loss and then go in my direction?”

The answer is liquidity.

Most beginner traders think price moves because of “buyers and sellers.”

But the real reason price moves is because big players need liquidity.

Understanding liquidity is like switching from retail trading to smart money thinking.

This blog will explain liquidity in simple words, step-by-step, with clear points.

What Exactly Is Liquidity (In Simple Words)

Liquidity means:

“Where people have placed their stop-losses and pending orders.”

These orders create a pool of money above or below price.

Examples:

- People buy → their stop-loss is below the swing low → liquidity there

- People sell → their stop-loss is above the swing high → liquidity there

So liquidity = clusters of stop-losses + pending orders.

The market needs these to move.

Why Big Players Hunt Liquidity

If you think the market is your friend… wait till it hunts your stop-loss.

Big players (banks/institutions) trade huge positions.

They cannot enter the market anywhere — they need a large amount of orders.

So what do they do?

They push price to areas where many stop-losses are sitting.

That gives them:

- Enough opposite orders to fill their big positions

- The best price for their entries

- Clean liquidity to run price in the direction they want

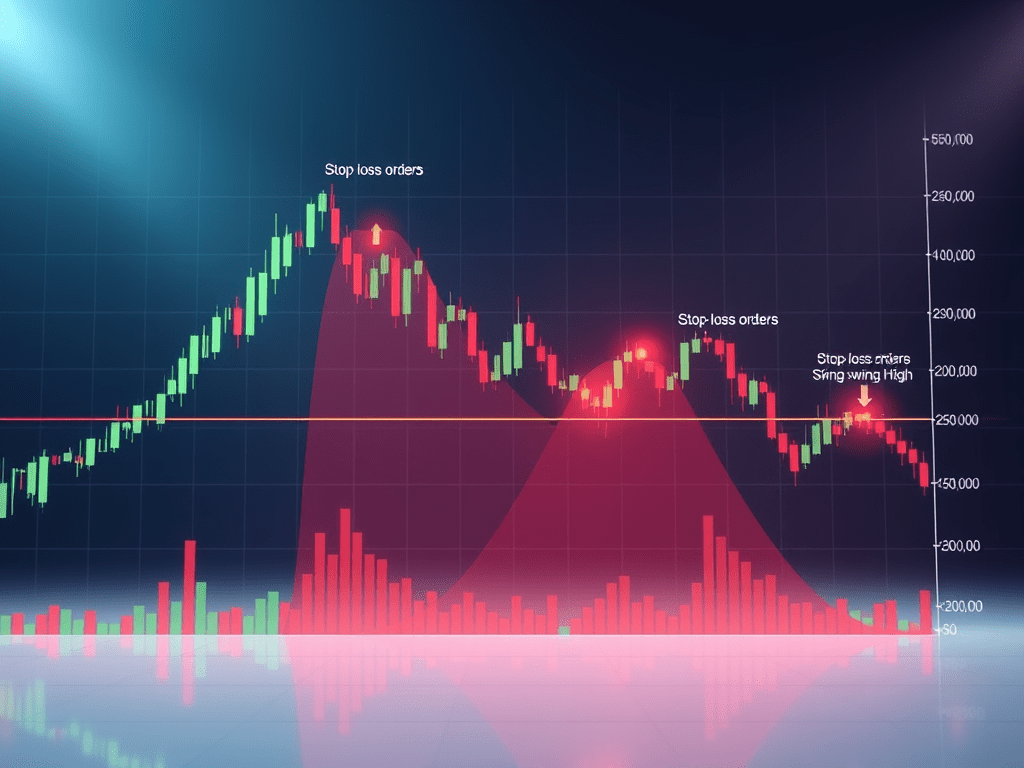

This process creates the famous pattern:

Stop-loss hit → sudden reversal → trend starts

That’s liquidity grab.

Where Liquidity Usually Sits (Very Important)

Liquidity forms in predictable places:

A. Above Previous Highs

Because retail traders sell at highs and place SL above the swing.

B. Below Previous Lows

Because retail traders buy at lows and keep SL under the swing.

C. Trendlines

People love trendlines → SL sits below/above → liquidity pool.

D. Double Tops & Double Bottoms

Retail thinks it’s “strong resistance/support”

Big players think it’s “free liquidity.”

E. Equal Highs / Equal Lows

Perfect same highs = stop-loss cluster.

F. Order blocks / Imbalances

These also tend to attract liquidity around them.

Price always seeks these levels.

The 3-Step Process of a Liquidity Grab (Simple Explanation)

Let me break this into steps you can observe in any chart:

Step 1: Build Liquidity

Price moves slowly and creates equal highs/lows.

Traders enter early, place SL tightly.

This is the “setup.”

Step 2: Stop-Hunt / Liquidity Sweep

Price spikes very fast in one direction.

This big candle:

- Triggers stop-losses

- Fills pending orders

- Captures liquidity

You think it’s a breakout; in reality it’s a trap.

Step 3: Real Move Begins (CHOCH Happens)

After collecting liquidity, price shows:

- Rejection

- Break of structure (CHOCH)

- Fast move in the opposite direction

This is where smart traders enter.

This is where the trend actually starts.

Liquidity + CHOCH = High-Probability Entry

This part is important for your trading strategy.

Here is the perfect sequence:

1. Identify liquidity (equal highs/lows, swing points)

2. Wait for a liquidity grab (stop-loss hunt)

3. Look for CHOCH on lower timeframe

4. Take entry on retracement (Golden Zone / FVG)

5. Place SL beyond liquidity grab

6. Target next liquidity zone

This is the same logic big players follow.

Real Example (Explained in Words)

Imagine EURUSD is moving slowly upward.

You see:

- Multiple equal highs → liquidity above

- Retail traders expect breakout

Then suddenly:

- Price shoots up fast → hits all SL

- Then instantly reverses

- Breaks structure to the downside (CHOCH)

- Pulls back to 62–79% Fibonacci

- Then drops strongly

This is textbook smart money behavior.

Why Retail Traders Lose Liquidity Hunts

Because they:

- Enter early

- Place SL at obvious places

- Assume breaks are real

- Trade emotions instead of structure

Smart traders:

- Let liquidity get taken

- Wait for CHOCH

- Enter on retracement

- Follow the higher timeframe levels

You don’t need 20 indicators.

Just understand how money flows.

How You Can Use Liquidity Starting Today

Here’s a simple routine you can apply right now:

Step 1: Mark Equal Highs/Lows on HTF

These are target zones.

Step 2: On LTF wait for liquidity sweep

One big spike → trap.

Step 3: Confirm with CHOCH

Structure break = real direction.

Step 4: Enter on retracement (FVG / Golden Zone)

This gives sniper entry + tight SL.

Step 5: Exit at next liquidity pool

Price always moves liquidity to liquidity.

Liquidity is not complicated.

It’s simply where traders place their money.

And big players use these areas to enter and move the market.

Once you understand liquidity:

- You will stop getting trapped

- Your entries will improve

- You will think like smart money

- You will see clean moves everywhere

Most importantly, you stop trading based on hope, and start trading based on logic.